how likely will capital gains tax change in 2021

If capital gains tax rates are not aligned with income tax changes should be introduced to the taxation of share based rewards for employees and small business owners. The Budget is fast approaching on 3 March 2021 and there is speculation that the rates of Capital Gains Tax CGT a tax on the difference between an assets value at.

Proposed Us Tax Changes 2022 What You Need To Know Right Now Sovereign Research

Joe Biden is set to propose a capital gains tax hike for the wealthiest reports said.

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

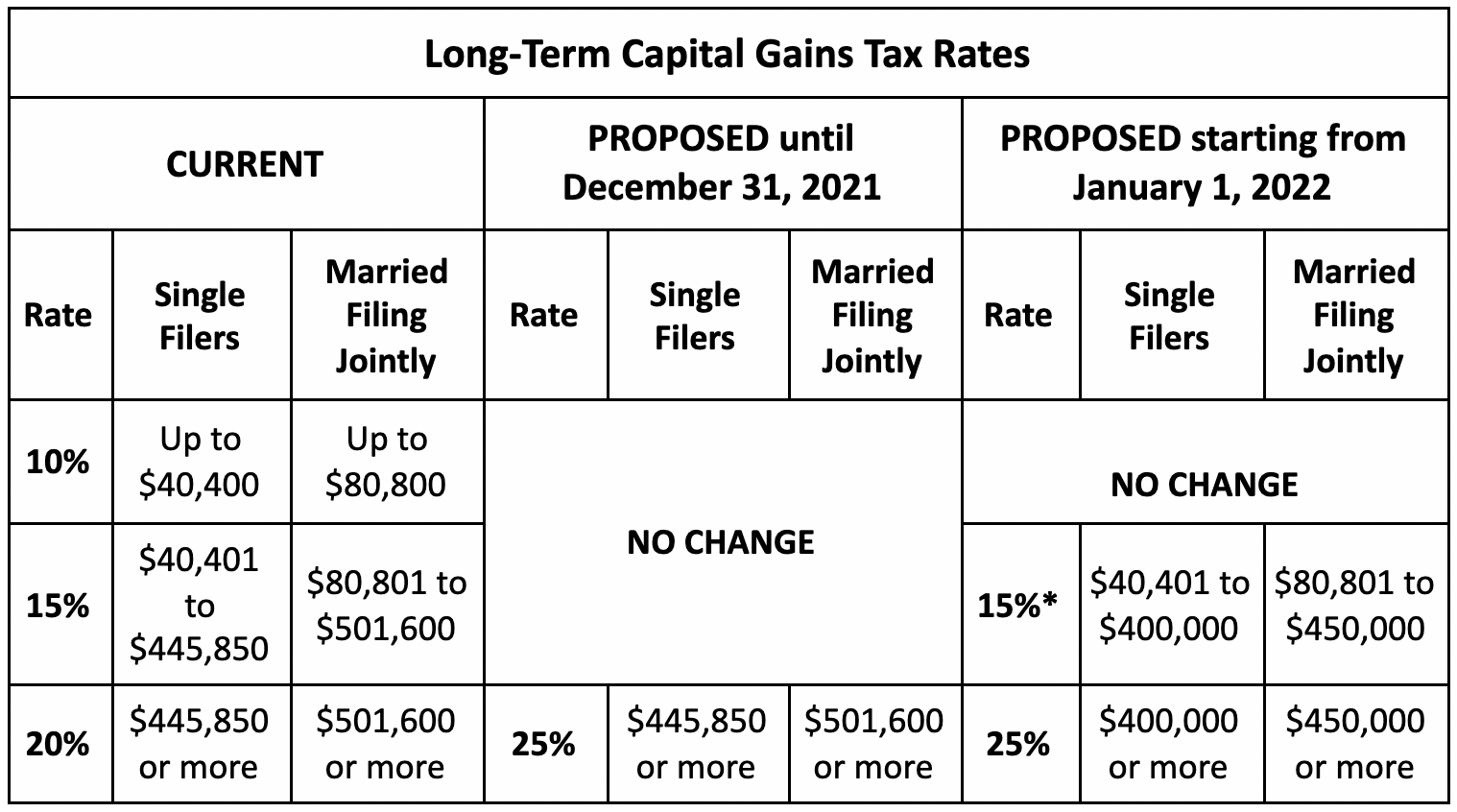

. Bidens tax plan called for a hike in the long-term capital gains tax rate but only for the richest Americans. In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. Specifically the current top capital gains rate is 238 20 plus a 38.

2022 capital gains tax rates. On April 28 2021 Joe Biden proposed to nearly double the capital gains tax for wealthy people to around 396. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income.

Tax Changes and Key Amounts for the 2022 Tax Year. House Democrats proposed a top federal rate of 25 on long-term capital gains by the House Ways and Means Committee. However it was struck down in March 2022.

The Chancellor will announce the next Budget on 3 March 2021. And if retroactive taking. Historically major changes to US tax policy have not been retroactive.

However if you earn less than. Capital gains tax is likely to rise to near 28 rather. A key issue is whether the change would apply retroactively to April 2021.

Taxpayers subject to the net investment income tax pay another 38 currently and would continue to pay that after any of the proposed increases are enacted. Long-Term Capital Gains Taxes. Many speculate that he will increase the rates of capital gains tax to help raise.

Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. There are seven federal income tax rates in 2023. The current capital gain tax rate for wealthy investors is 20.

In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year. Implications for business owners. With both the Senate and the House under Democratic control the Biden administration could potentially still make changes to the capital gains tax in 2021.

The maximum rate would be 288 when combined. The proposal would increase the maximum stated capital gain rate from 20 to 25. In 2021 a bill was passed that would impose a 7 tax on long-term capital gains above 250000 starting with the 2022 tax year.

2021 capital gains tax calculator. Apr 23 2021 305 AM. The changes in tax rates could be as follows.

The effective date for this increase would be September 13 2021. This could result in a significant increase in CGT rates if this recommendation is implemented. Proposed changes to Capital Gains Tax.

Estate Taxes Under Biden Administration May See Changes

/capital_gains_tax.asp-Final-60dadf431693474ba6e99cd1f32440cd.png)

Capital Gains Tax What It Is How It Works And Current Rates

How Does The Capital Gains Tax Work Now And What Are Some Proposed Reforms

How Are Capital Gains Taxed Tax Policy Center

Perspective Biden To Seek Tax Changes On High Earners Capital Gains Some Businesses Lvb

Biden S Capital Gains Tax Plan For 2021 Thinkadvisor

Managing Capital Gains Tax In 2021 And Beyond Ultimate Estate Planner

An Overview Of Capital Gains Taxes Tax Foundation

State Taxes On Capital Gains Center On Budget And Policy Priorities

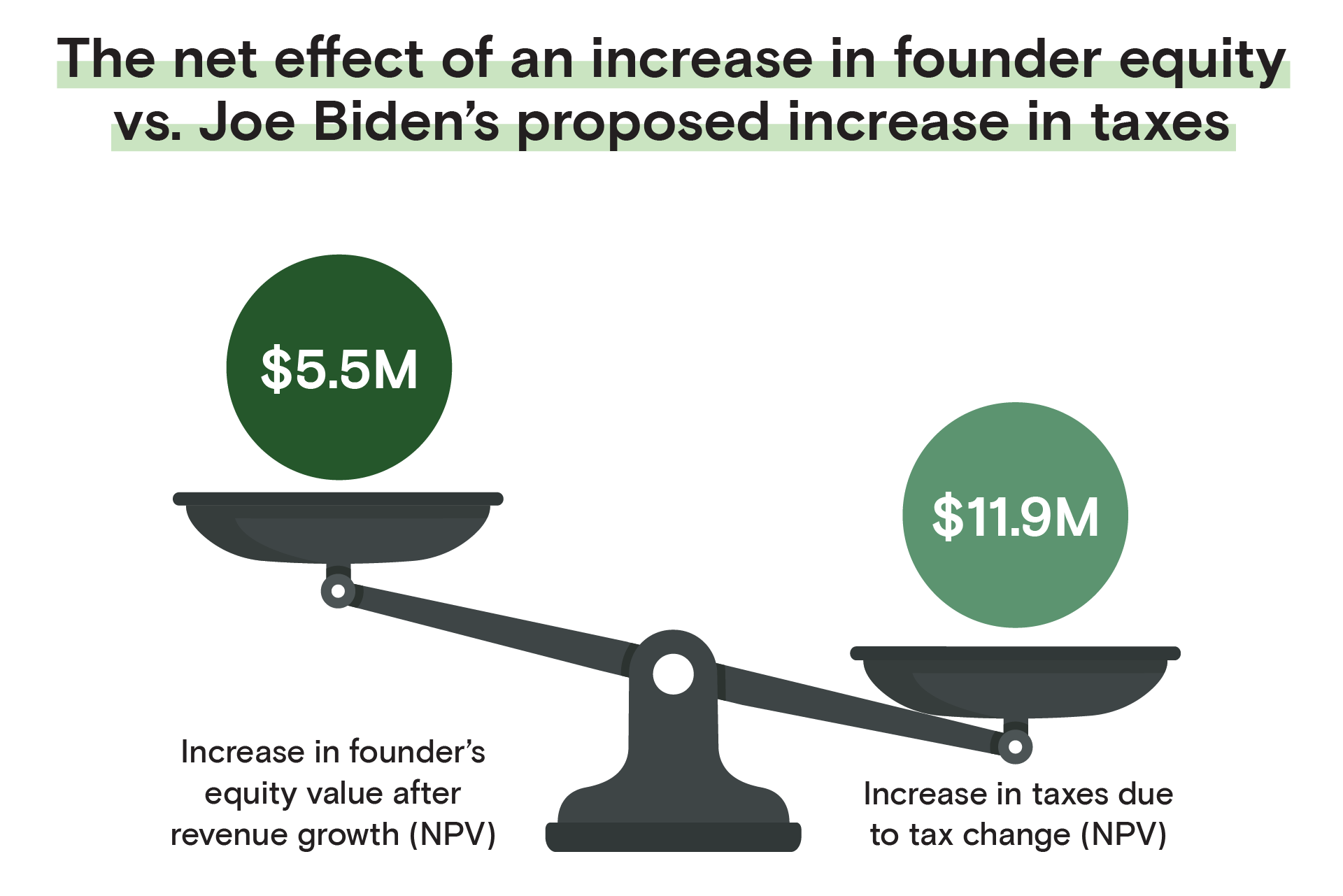

For Founders The Implications Of Joe Biden S Proposed Tax Code

What You Need To Know About Capital Gains Tax

The Real Question On A Capital Gains Hike Is Whether It S Retroactive

Here S How Capital Gains Tax Changes Could Impact Your Clients Estate Planning For 2022 Vanilla

Biden S Capital Gains Tax Hike What It Means For Your Taxes Cnet

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

President Biden S Capital Gains Tax Plan Forbes Advisor

Biden Wants To Nearly Double Capital Gains Tax Here S What That Means

Democrats Propose Higher 25 Capital Gains Tax Rate Here Are 3 Ways To Minimize The Potential Hit Bankrate

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)